About

Portland: The Hub of Coastal Maine

Portland is the largest city in Maine, with an estimated population of 67,000 as of 2017. The city is comprised of several distinct areas, including the Old Port district, Peak’s Island, downtown and others. According to the United States Census Bureau, Portland is comprised of 21.31 square miles of land and 48.13 square miles of water. Portland borders the beautiful Casco Bay on the Atlantic Ocean. Surrounding towns include Falmouth, Westbrook and South Portland.

Portland is best known for its marine industry, appreciation for the arts, it’s 19th-century architecture and of late, it’s growing impressive culinary scene. Just 105 miles from Boston, Portland is also in close proximity to Portsmouth and Hampton, New Hampshire, as well as other tourists favorites in Maine. Visitors can be in Kennebunk in just 25 minutes, in Augusta in 55 minutes and up to Bangor, Maine in roughly two hours.

The city’s technology sector has grown significantly over the past several years, with the headquarters of companies such as WEX calling Portland home. IDEXX, Pioneer Telephone and Burnham & Morrill Co., maker of B&M Baked Beans, are all also headquartered in Portland, Maine.

For visitors, Portland has tons to offer. Whether you’re looking to experience the true Maine experience and explore the city’s lighthouses and beautiful shore, or you prefer to walk the cobblestone streets of the Old Port and shop at the city’s local boutiques, you won’t be disappointed. In fact, TripAdvisor named Portland, Maine one of the Top 10 Destinations to visit.

In terms of weather, Portland is super diverse. Generally, the city’s winters are cold and snowy, with high temperatures in January hovering around 30 degrees. In the summertime, Portland is the place to be, with highs in the 80’s, and just a few days in July hitting 90 degrees. Annual rainfall averages approximately 47.2 inches, however summers in Portland are generally fairly dry.

If you’re looking to enjoy the beautiful outdoors, Portland won’t disappoint. The city features more than 700 acres of open space and public parks and its surrounding communities offer 70 miles of trails, both urban and wooded, maintained by the nonprofit Portland Trails. Impressively, the Portland City Council banned the use of synthetic pesticides in all Portland parks in 2018. Some well-known parks in the city include the Eastern and Western Promenades, Lincoln Park, Congress Square Park, Fort Sumner Park and the Quarry Run Dog Park.

5 Fast Facts About Portland, Maine:

-

Several famous movies have been filmed in Portland, including ‘Message in a Bottle,’ ‘The Preacher's Wife’ and ‘Thinner.’

-

Portland’s new public transportation train system opened for business in 2016.

-

Portland, Oregon was named after Portland, Maine.

-

The city broke away from Old Falmouth in 1786 on July 4th.

-

Portland is the closest transatlantic port in the U.S. to Europe.

Accommodations in Portland: Where to Stay

Portland offers a diverse range of accommodations to suit every traveler's needs. Whether you prefer upscale hotels with breathtaking ocean views or cozy bed and breakfasts in historic neighborhoods, you'll find plenty of options. Notable choices include the Courtyard Marriott overlooking the harbor, the Best Bower on top of Munjoy Hill with vistas out into Casco Bay or even an island stay with the Inn on Peak’s Island. This city’s unique geography means there there are lodging options for all tastes and preferences

Culinary Delights: Dining in Portland

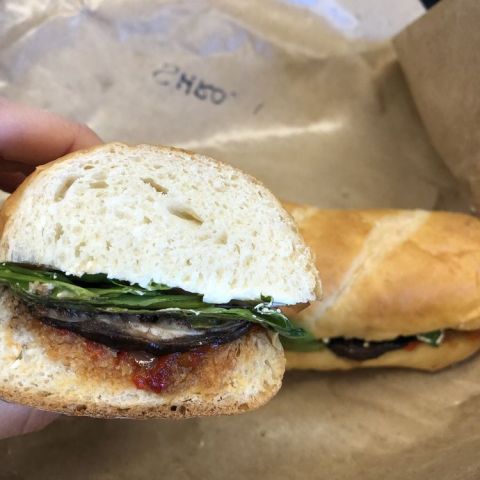

One of the highlights of visiting Portland is its vibrant food scene. The city boasts a remarkable array of restaurants, cafes, and eateries, many of which specialize in serving fresh seafood caught from the nearby waters. Some must-visit spots include Eventide Oyster Co., known for its lobster rolls, and Central Provisions, a trendy eatery offering creative small plates. Portland’s advantage with seafood is that their catches are guaranteed fresh and Maine’s well-protected ecosystems mean that the quarries are from well-preserved and unpolluted waters. Maine’s commitment to sustainability also means that its farms are very productive in producing quality ingredients and raw meats. It is no wonder that aside from the traditional Maine seafood options, Portland boasts hundreds of restaurants in every style and flavor. Name a cuisine and there are most likely several restaurant options to choose from, just in downtown Portland.

Things to Do in Portland: Activities for All Ages

Portland provides an abundance of activities for families, couples, and solo travelers. Outdoor enthusiasts can explore nearby state parks, go whale watching, or relax on beautiful sandy beaches. For those interested in history and culture, there are numerous historical societies and museums to visit, including the Maine Historical Society and the Portland Museum of Art.

Q&A:

1. What is the best time to visit Portland, Maine?

The best time to visit Portland is during the summer months when the weather is mild, and outdoor activities are in full swing. However, the city's charm extends throughout the year, with each season offering its own unique appeal.

2. Is Portland a family-friendly destination?

Yes, Portland is incredibly family-friendly. It is one of America’s most walkable cities so families can enjoy the city's parks, museums, and nearby beaches, making it an excellent destination for all ages.

3. What is Portland's signature dish?

Portland is renowned for its fresh seafood, and the lobster roll is a must-try delicacy. Although foodies would also recommend soft-shelled clams and Pemaquid Oysters as must-haves while visiting Portland.

Hotels:

Hotels:

Restaurants:

Restaurants: